[ad_1]

The S&P 500 index exited a bear market on Thursday, while a closely watched gauge of stock-market volatility dropped to a more-than-three-year low. Those two things are related, says Fundstrat Global Advisors founder Tom Lee.

The Cboe Volatility Index

VIX,

an options-derived measure of expected volatility in the S&P 500 over the coming 30 days, traded as low as 13.50 on Friday, its lowest since February 2020. The gauge’s long-term average is near 19. A subdued reading indicates investors are feeling optimistic. The VIX averaged 25 in 2022, while the S&P 500 posted a decline of 19.4%.

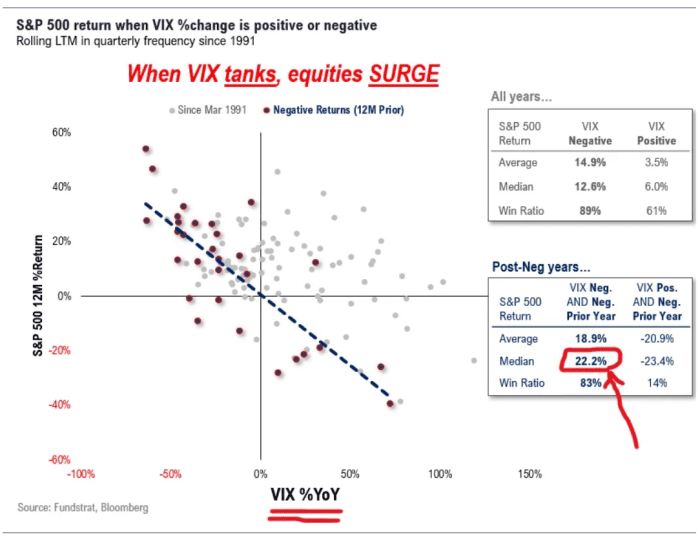

“The VIX impact is the least appreciated. Our work from December 2022 shows that in last 30 years, post-negative equity year (2022), when VIX is down [year-over-year], the median gain is 22%,” Lee said in a Friday morning note to clients (see chart below).

Fundstrat

The VIX’s role is larger than the impact from moves in the U.S. dollar, earnings per share or even bond yields, Lee said.

“VIX trajectory, in other words, was the single biggest determinant at the start of 2023. This seems to be playing out today,” he wrote.

The S&P 500

SPX,

was up 0.2% late Friday afternoon to trade just above 4,300. On Thursday it closed at 4,293.93, its highest close since Aug. 16. Moreover, it finished more than 20% above its Oct. 12, 2022, closing low, meeting widely used criteria that marks the end of a bear market.

The Dow Jones Industrial Average DJIA was up 65 points, or 0.2%.

But there are plenty of skeptics who see a headfake rather than a newborn bull market. The concentrated nature of the S&P 500’s rally, which has been fueled to an extreme degree by gains for a handful of megacap, tech-related stocks, makes many investors wary because the average stock has been left behind.

While the S&P 500, which is weighted by market capitalization, is up more than 12% so far in 2023, the equal-weighted measure of the S&P 500 has gained just 2.6%.

Read: Will Big Tech’s rally finally spread to the broader stock market?

Others fear an uncertain economic outlook, arguing that a more pessimistic take reflected in the bond market could quickly unravel the stock market rally if it proves correct.

Need to Know: Stocks would fall right back into a bear market if they adopted economic view of bond market, JPMorgan says

So now what? Lee said with the VIX below 14, it likely won’t be a driver of future gains.

Now, the market faces what may be its “most consequential” week of the year, with the May consumer-price index set for release on Tuesday and the Federal Reserve concluding a two-day policy meeting on Wednesday.

Fed-funds futures traders have priced in a roughly 72% probability the central bank will leave rates unchanged next week, according to the CME FedWatch tool, pausing after a series of rate increases that took the benchmark rate from near zero to the current range of 5% to 5.25% since March of last year. But they expect the Fed to deliver a hike in July.

See: Fed might hike interest rates again in June instead of a ‘skip,’ some economists think

While the VIX at its current level isn’t necessarily a buy signal on its own, “we still see upside drivers for the S&P 500 over the next 6 months. The main driver being that inflationary pressures ease faster than consensus expects and at a pace that will allow the Fed to slow its pace of hikes,” Lee said.

With the caveat that next week’s events are crucial, Fundstrat’s base case remains that the S&P 500 will gain more than 20% in 2023, with the 4,300 level serving as a “waypoint” that will eventually give way to equity markets making new highs this year, he said.

[ad_2]

Source link

Leave a Reply