[ad_1]

U.K. bond yields jumped Wednesday after data showing inflation lingering above 10%.

The yield on the 2-year gilt

TMBMKGB-02Y,

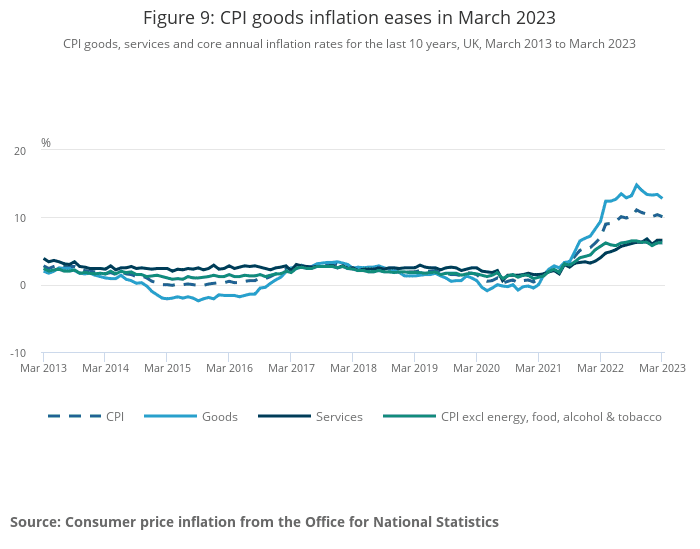

rose 13 basis points to 3.81% as the Office for National Statistics reported that inflation in March slowed to 10.1% year-over-year from 10.4%, and that core inflation stayed at 6.2%. Economists polled by Reuters expected inflation to ease to 9.8%.

The pound

GBPUSD,

moved up to $1.2466 from $1.2424.

Unlike in the U.S., core goods inflation has remained stubbornly high, owing to prices on clothing and furniture, despite a drop in durable-goods prices.

ONS

“It’s not quite a slam dunk for a May rate hike – though markets are fully pricing that outcome now. We agree that it’s now probably more likely than not in light of this week’s inflation and wage data, having up until now forecasted no change,” said James Smith, developed market economist at ING.

In fact, markets are now more than fully pricing in a rate hike, with expectations now of a 27 basis point increase, as markets also assign an 82% chance of a June rate rise.

Chancellor of the Exchequer Jeremy Hunt reiterated the government’s view that inflation will be halved this year, citing forecasts from the Office for Budget Responsibility.

[ad_2]

Source link

Leave a Reply