[ad_1]

The stock market, as measured by the S&P 500 Index

SPX,

has begun to pull back a bit. The run upward after breaking out over 4300 on June 9 was a strong move. This produced several overbought conditions, although no tradeable sell signals yet. So, the current small (so far) retreat is not worrisome. We are also in a short, negative seasonal time period.

There should be support at both 4200 and 4300 since these were previously resistance areas on the way up. A move below 4200 would be quite negative and would suggest that this latest upside action was nothing more than a false move.

SPX closed above its +4σ “modified Bollinger Band” for several days and now has closed below the +3σ Band. That constitutes a “classic” mBB sell signal. We do not trade those, since even though they have a profitable overall track record, there were too many false signals. So, we have inserted the requirement for further confirmation in order to generate a McMillan Volatility Band (MVB) sell signal. That signal still lies in the future, if it is to exist at all (not every “classic” sell signal eventually generates an MVB sell signal). In short, if SPX closes below 4351, that will generate the MVB sell signal.

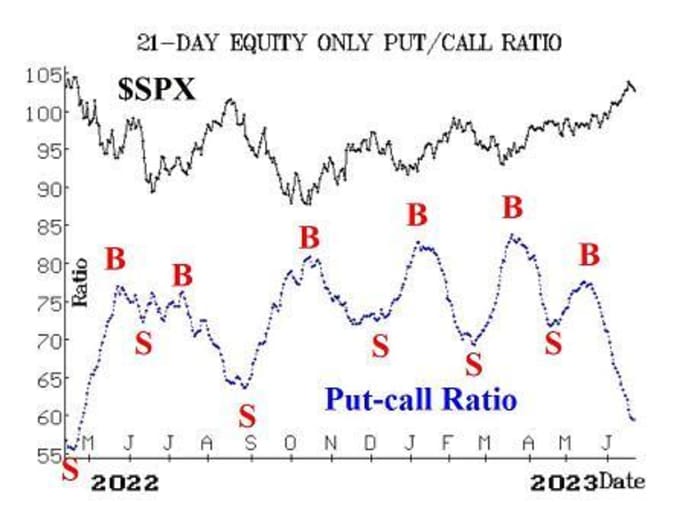

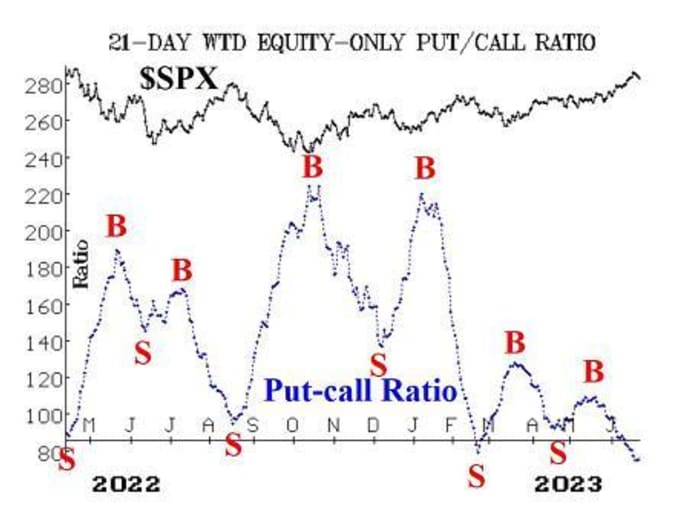

Equity-only put-call ratios continue to fall. They are now at extreme lows on their charts, meaning they are in very overbought territory. They are at or below levels at which recent sell signals in the last year or two were generated. We do not consider where past levels of sell signals occurred, though, for we are only interested in the trend of the ratio. As long as these ratios continue to fall, they will be on buy signals. Only when they roll over and begin to rise will sell signals be in place.

Breadth has been moving back and forth; the breadth oscillators are essentially useless indicators right now. On Wednesday, for instance, NYSE breadth was slightly positive but any broader-based measure of breadth was negative. There have been multiple days like this in recent weeks, in both directions. For the record, the breadth oscillators are on sell signals at the moment, but we are not taking a position based on them.

NYSE New 52-week Highs continue to outpace New 52-week Lows. Thus, this indicator remains on the buy signal that was first generated on June 7.

VIX

VIX,

has continued to drop, even as SPX has pulled back from its recent highs. VIX is trading at its lowest levels since January 2020, just before the pandemic crisis. While some might consider VIX to be overbought at these currently-low levels, it is still not negative. VIX itself would only generate a warning/sell signal if it were to rise sharply, returning to what we call “spiking” mode.

When VIX is in “spiking” mode, the stock market can fall swiftly, although eventually a buy signal would arise out of that. For VIX to enter “spiking” mode, it would have to rise by at least 3.00 points (using closing prices) over any 1-, 2-, or 3-day period. Today, VIX would have to close above 16.20 to enter “spiking” mode. Meanwhile, the trend of VIX buy signal that was issued in March still remains in place.

The construct of volatility derivatives continues to generate bullish signals as far as the stock market is concerned. The term structures of VIX futures and of CBOE Volatility Indices slope upwards, and the VIX futures are trading at large premiums to VIX. The July VIX futures are now the front month, so any warning sign of trouble would be if the July VIX futures were to rise in price above the August VIX futures. That doesn’t seem likely in the near future.

In summary, we are maintaining a “core” bullish position because of the positive nature of the SPX chart. We will continue to trade other established and confirmed signals around that “core” position.

New recommendation: Potential MVB sell signal

As discussed above, a “classic” mBB sell signal occurred on June 21. The low for SPX on that day was 4151. So, a close by SPX below that level will generate a MVB sell signal, which we will trade.

IF SPX closes below 4151, then Buy 1 SPY

SPY,

Aug (18th) at-the-money put

And Sell 1 SPY Aug (18th) put with a striking price 30 points lower.

If this signal occurs, we will then hold it until SPX trades at the -4σ Band (the profit “target”) or trades above the +4σ Band, which would stop out the trade (and would simultaneously set up a new sell signal, perhaps).

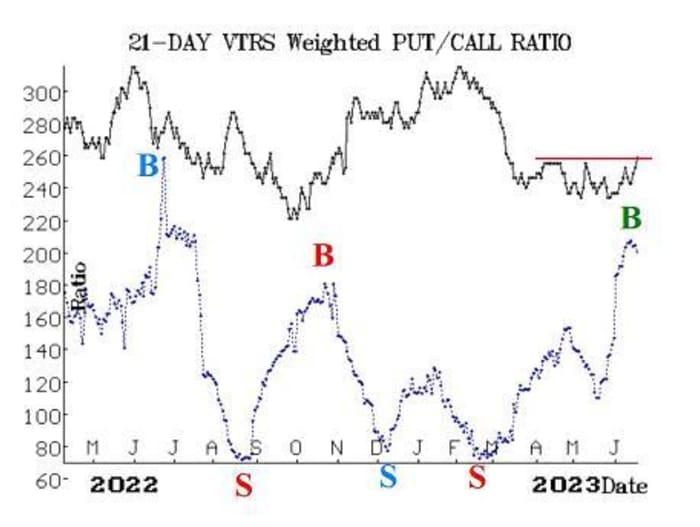

New recommendation: Viatris Inc. (VTRS)

There has been a new buy signal from the weighted put-call ratio in VTRS. We are going to take a long call position.

Buy 10 VTRS August (18th) 10 calls at a price of 0.60 or lower.

VTRS

VTRS,

: 10.01 Aug (18th) 10 calls: 0.50 bid, offered at 0.60

Follow-up action:

We are using a “standard” rolling procedure for our SPY spreads: in any vertical bull or bear spread, if the underlying hits the short strike, then roll the entire spread. That would be roll up in the case of a call bull spread, or roll down in the case of a bear put spread. Stay in the same expiration and keep the distance between the strikes the same unless otherwise instructed.

Long 3 AMAM

AMAM,

July (21st) 12.5 calls: Raise the trailing stop to 13.00.

Long 4 HAL July (21st) 30 calls: Hold this HAL

HAL,

position as long as the weighted put-call ratio remains on a buy signal.

Long 0 MXL July (21st) 30 puts: Stopped out when MXL

MXL,

closed above 31 on June 20th.

Long 800 KOPN

KOPN,

: The stop remains at 1.70.

Long 2 SPY July (7th) 439 calls: Bought on the upside breakout. This is our “core” bullish position. Stop out of this trade if SPX closes below 4200. The position was rolled up once. Roll up every time your long SPY option is at least 6 points in-the-money.

Long 1 SPY July (7th) 439 call: Bought in line with the “New Highs vs. New Lows” buy signal. Stop out of this trade if, on the NYSE, New Lows outnumber New Highs for two consecutive days. The position was rolled up once. Roll up every time your long SPY option is at least 6 points in-the-money.

Long 2 PFG

PFG,

July (21st) 70 calls: we will hold these calls as long as the weighted put-call ratio remains on a buy signal.

All stops are mental closing stops unless otherwise noted.

Send questions to: [email protected].

Lawrence G. McMillan is president of McMillan Analysis, a registered investment and commodity trading advisor. McMillan may hold positions in securities recommended in this report, both personally and in client accounts. He is an experienced trader and money manager and is the author of the best-selling book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an investment advisor and with the CFTC as a commodity trading advisor. The information in this newsletter has been carefully compiled from sources believed to be reliable, but accuracy and completeness are not guaranteed. The officers or directors of McMillan Analysis Corporation, or accounts managed by such persons may have positions in the securities recommended in the advisory.

[ad_2]

Source link

Leave a Reply