[ad_1]

What did we learn last week? Some big banks are holding up okay after last month’s tremors, thanks to rising rates. That, along with cooling inflation, helped the Dow industrials

DJIA

close out its longest weekly winning streak since October.

Will optimism hold as earnings season gets fully under way this week and is banking stress done? Our call of the day, from Morgan Stanley’s chief U.S. equity strategist Mike Wilson, warns of a long shadow cast by March stress, despite a mostly upbeat stock market.

“In contrast to what we expected, the S&P 500

SPX

and Nasdaq

COMP

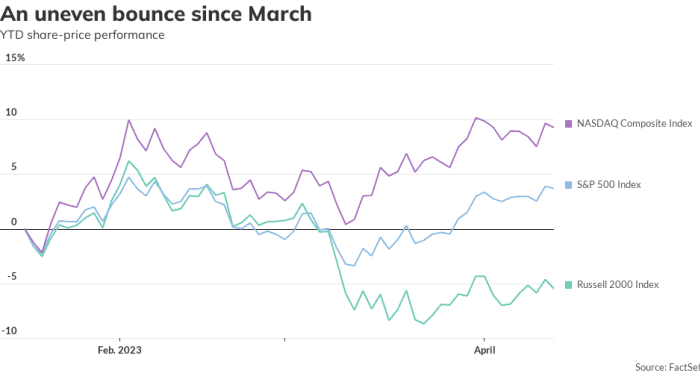

have traded well since SVB [Silicon Valley Bank] first announced it was insolvent. However, small-caps, banks and other highly levered stocks have traded poorly as the market leadership turned more defensive, in line with our sector and style recommendations,” Wilson tells clients in a new note.

The strategist credits “defensive/high-quality characteristics and lower back-end rates” for holding up bigger indexes, but warns against breathing easy here. “On the contrary, the gradual deterioration in the growth outlook continues, which means even these large-cap indexes are at risk of a sudden fall like those we have witnessed in the regional banking index and small-caps,” says Wilson.

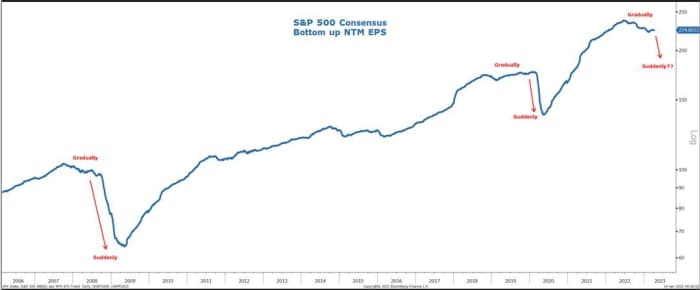

He uses a quote from one of Ernest Hemingway’s novels to get his point across. In “The Sun Also Rises,” a character, asked how he went bankrupt, responds: “Two ways…Gradually, then suddenly.” Last month’s bank failures were blamed on a gradual build up of risk from long-duration Treasury holdings and concentrated deposit over the past year that suddenly accelerated, noted Wilson. And as most didn’t see those coming, investors need to stay alert for more fallout, he warns.

One area to watch — earnings and a “gradually, then suddenly,” decline in estimates. Since last June’s peak, the forward 12-month bottom-up consensus earnings per share (EPS) S&P 500 forecast has fallen by around 9% per annum, “which is not severe enough for equity investors to demand the higher equity risk premium we think they should,” says Wilson. And he is neither swayed by consensus earnings forecasts that imply the first quarter will mark an EPS trough — usually a buy signal.

Last week’s bigger-than-inflation drop may also pose trouble for companies, as it hints of sagging demand, as “inflation is the one thing holding up revenue growth for many businesses,” says Wilson.

“The gradually eroding margins to date have been mostly a function of bloated cost structures. If/when revenues begin to disappoint, that margin degradation can be much more sudden, and that’s when the market can suddenly get in front of the earnings decline we are forecasting, too,” he said.

Bloomberg, Morgan Stanley Research

The markets

Stock futures

ES00

NQ00

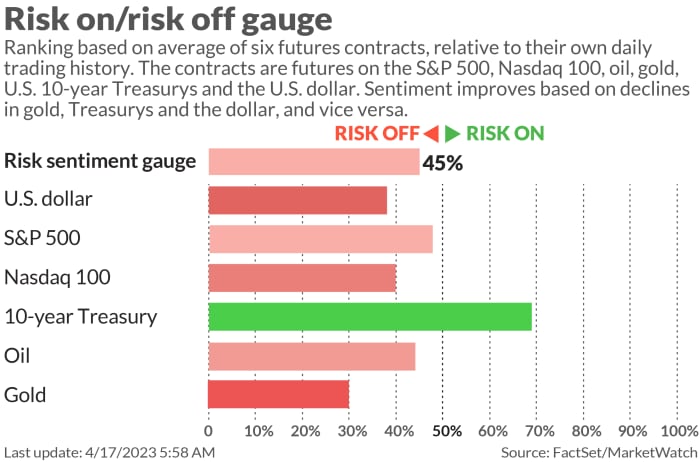

are steady, but hint Wall Street may start near 2023 highs, while Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

rose and the dollar

DXY

inched up. Oil prices

CL

are tilting lower.

Read: Here’s why ‘soft’ commodity prices, such as orange juice and sugar are soaring.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The financial sector stays in the spotlight as earnings season heats up with Charles Schwab

SCHW

reporting. The rest of the week will see Bank of America

BAC,

Goldman Sachs

GS

and Netflix

NFLX

report Tuesday, with Tesla

TSLA

and Morgan Stanley

MS

on Wednesday, and many more throughout the week.

Netflix also apologized over a glitch to its “Love is Blind” reunion show.

Tesla, Netflix earnings due: Cheaper cars, cheaper content, more workout videos, as ‘earnings recession’ seems likely

Prometheus Biosciences

RXDX

stock is soaring 70% after pharma group Merck

MRK

said it would buy the clinical-stage biotech company for $200 a share, or about $10.8 billion. Merck shares are down slightly.

Infosys shares

IN:500209

plunged in India on Monday after losses last week stemming from the IT tech outsourcing group’s gloomy results. JPMorgan downgraded the company to underweight.

Finnish-based Angry Birds maker Rovio Entertainment

FI:ROVIO

agreed to a $776.1 million takeover deal from Sonic the Hedgehog owner, Japan’s Sega Sammy Holdings

JP:6460.

The Empire State manufacturing index for April is due at 8:30 a.m., followed by a home builder confidence index at 10 a.m. and a speech by Richmond Fed President Tom Barkin. House Speaker Kevin McCarthy is due to make remarks at the New York Stock Exchange on Monday, where he’s expected to focus on the debt limit.

Best of the web

High-school students should aim for tech jobs over finance, says a poll of investors.

The chart

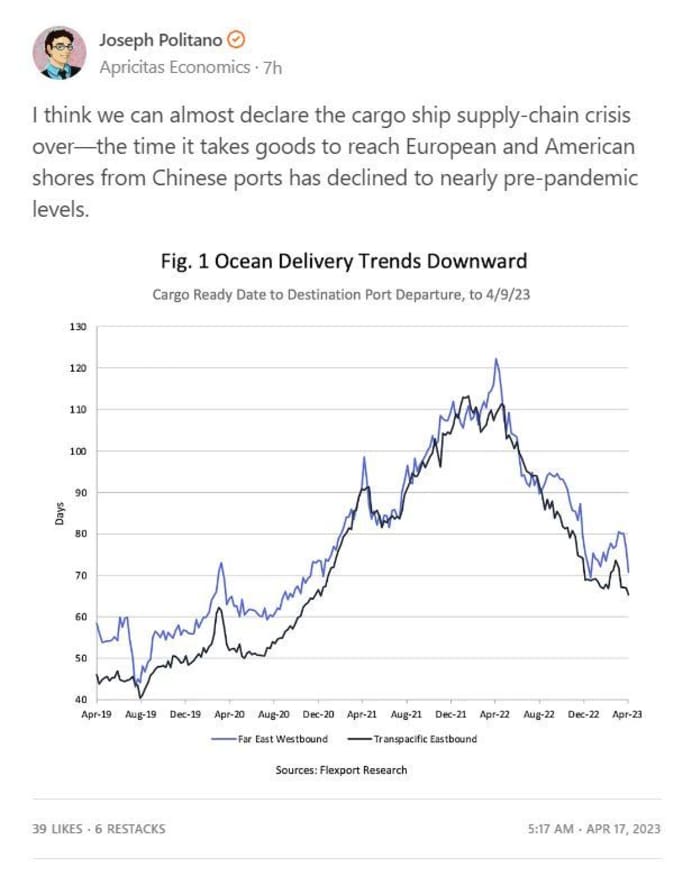

And now an update on the supply-chain crisis that hit the cargo industry in a big way last year:

Joseph Politano, Apricitas Economics

Read the full post on Substack.

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m.:

| TSLA | Tesla |

| BUD | Anheuser-Busch InBev |

| INFY | Infosys |

| AMC | AMC Entertainment |

| BBBY | Bed Bath & Beyond |

| GME | GameStop |

| NIO | Nio |

| MULN | Mullen Automotive |

| AAPL | Apple |

| CNSP | CNS Pharmaceuticals |

| APE | AMC Entertainment preferred shares |

Random reads

After Bud Light’s recent panned ad campaign, Budweiser brings out its Clydesdale horses.

Fountains once flowed with wine at this ancient Roman villa.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link

Leave a Reply