[ad_1]

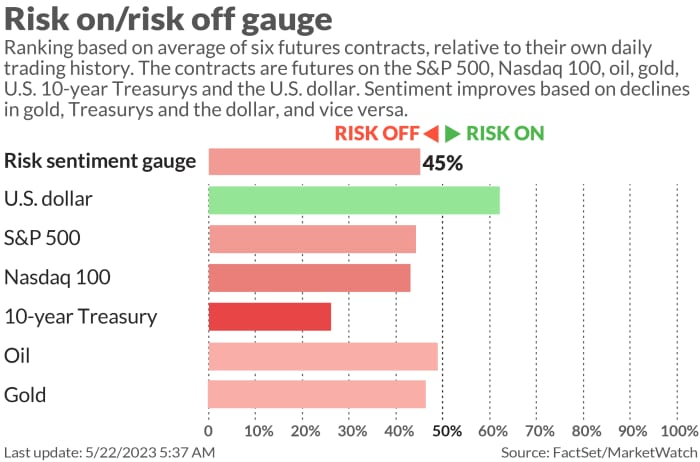

The last full week of trading for May is set to kick off on a subdued note, as markets wait for progress on the debt ceiling and more Fed clarity on interest rate direction.

But the S&P 500’s

SPX

surprising bust out of a range last week has opened up a debate on Wall Street about whether or not that move has any teeth to it. Morgan Stanley’s Mike Wilson, in our call of the day, sees a dangerous trap.

“Last week’s price action showed signs of panic by investors who are afraid they’ll miss the next bull market. We believe this will prove to be a head fake rally like last summer’s for many reasons,” Wilson told clients in a Sunday note.

“With the index showing some signs that it wants to break out, market internals are much less attractive today and leadership has changed dramatically,” he says.

Read: How to invest in one of the hottest stock market sectors while cutting your risk

For example, he sees not just the top 10-20 stocks looking expensive, but the S&P 500 median stock forward price/earnings [P/E] ratio at 18.3 times, and S&P 500 ex-tech median P/E at 18 — both within the top 15% of historical levels.

Second, a “very healthy re-acceleration” is baked into second-half consensus forecasts for earnings, but Morgan Stanley’s forecasts “continue to point materially lower.” Wilson says their own model has been highly accurate over time and recently.

He said they started warning of an earnings recession a year ago, and got a lot of pushback. “However, our model proved quite prescient based on the results and is now projecting a much more dire outcome than consensus. Given its historical and more recent track record, we think consensus estimates are off by as much as 20% for this year,” said Wilson.

What else? Stocks are pricing in Fed cuts before year end without “material implications” for growth, while Wilson sees easing only if a recession is clearly coming, or bank stress is spreading. Other worries: signs of waning consumer strength, and the possibility that raising the debt ceiling will weigh on market liquidity due to sizeable Treasury issuance seen in the next six months after it passes.

Also seeing trouble on the horizon is Michael Kramer, portfolio manager of the Mott Capital Thematic Growth Portfolio. In a Substack post, he talks about a stalemate that will be tricky for investors to navigate.

“Presently, the options market does not seem to provide the equity market with the necessary impetus to move higher. As long as this situation persists, both the index and the bulls remain trapped. While it is possible for the index to reach 4,225, I have reservations about its ability to surpass that level given the prevailing dynamics,” he said.

He now expects big market makers to sell S&P 500 futures above 4,200, therefore keeping upward movement limited, but also act as sellers of the S&P 500 below 4,150.

Mott Capital Management

Read: Big Tech still has the power to extend the rally and weather an economic storm, analysts say.

The markets

Stock futures

ES00

NQ00

are tilting south, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

and oil prices

CL

weakening. Investors aren’t giving gold

GC00

and silver

SI00

much love either. Asian stocks

JP:NIK

HK:HSI

had a mostly upbeat session.

Greek stocks

GR:GD

are surging after a landslide victory by the ruling conservative party.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

President Joe Biden and House Speaker Kevin McCarthy will resume debt-ceiling talks on Monday, and also had a phone call, which McCarthy said was “productive.” Biden also said he could invoke the 14th Amendment to solve the crisis, though it may be too late.

China’s government has told tech manufacturers to stop buying chips from Micron Technology

MU,

citing “serious network security risks.” Micron shares slumped in premarket trade.

PacWest shares

PACW

are up 5% in premarket after the regional lender said it will sell a portfolio of 74 real estate construction loans.

Shares of Swiss biotech VectivBio

VECT

are up 40% after Ironwood Pharmaceuticals

IRWD

announced a $1 billion deal for the Swiss biotech.

Facebook parent Meta Platforms

META

has been fined a record $1.3 billion by the EU that has ordered it to stop transferring user data across the Atlantic.

Minneapolis Fed President Neel Kashkari told the Wall Street Journal that he’s open to a rate-hike pause at the next Fed meeting. There are more Fed speakers on Monday, and St. Louis President James Bullard kickstarts the parade at 8:30 a.m.

Monday’s data calendar is quiet, but the week’s highlights include second-quarter GDP, PMIs, home sales, Fed minutes and the Fed’s favorite inflation indicator, the PCE price index.

An earnings dump from retailers that cater to lower-and-middle-income shoppers will roll out this week — Kohl’s

KSS,

Dollar Tree

DLTR,

Costco

COST

and Best Buy

BBY

to name a few. Chipmaker and hot AI stock, Nvidia

NVDA,

will report on Wednesday.

Best of the web

After the pause: This is how borrowers are preparing for resumption of student-debt payments

The chart

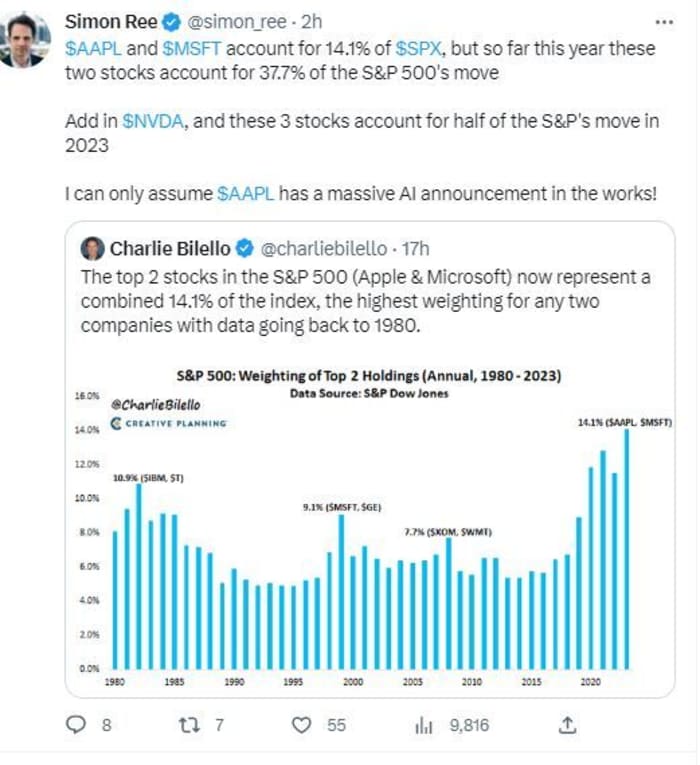

Here’s another look at tech’s heavy representation in the market right now:

@simon_ree and @charliebilello

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| NVDA | Nvidia |

| AMC | AMC Entertainment |

| AAPL | Apple |

| MULN | Mullen Automotive |

| AMZN | Amazon.com |

| BUD | Anheuser-Busch InBev |

| PLTR | Palantir Technologies |

| BABA | Alibaba |

Random reads

Spot the Nike ‘swoosh’ on this 400-year old painting.

Climate activists in Italy turned Rome’s famous Trevi Fountain black.

Hard to miss at Cannes: Jeff Bezos’ 246-foot superyacht

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

[ad_2]

Source link

Leave a Reply