[ad_1]

A new week is pointing to a perky start for Wall Street, with stock futures in the green. But one might wonder “What gives?” as old worries — banking sector concerns and a debt-ceiling standoff — lurk, and some market observers assure the S&P 500

SPX

is going nowhere until those are resolved.

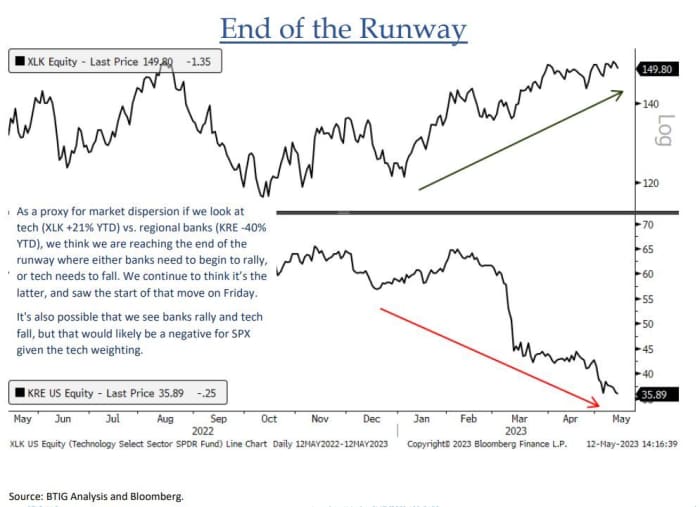

But that index may be nearing the breaking point sooner than any Washington solution can get there, judging by the technical setup, says our call of the day from BTIG’s chief market technician, Jonathan Krinsky.

“We think we are reaching the end of the runway, where either banks need to begin to rally, or tech needs to fall. We continue to think it’s the latter and saw the start of that move on Friday,” Krinsky told clients in a note. The Nasdaq Composite

COMP

didn’t go careening south, but did see its first drop in three sessions, losing 0.3%.

And he added that the largest six-weighted names in the Nasdaq are pushing into major resistance levels. That is Microsoft

MSFT,

Apple

AAPL,

Amazon

AMZN,

Nvidia

NVDA,

Alphabet

GOOGL

and Meta

META.

If tech names start to give way, that won’t be good for the S&P 500 given the weighting of the sector in that index, he said, adding that a bank rally would be better news, though it seems less likely.

Using exchange-traded funds as proxies, Krinsky notes that tech is up 21% year to date, via the Technology Select Sector ETF

XLK,

while regional banks, via the SPDR S&P Regional Banking ETF

KRE,

are down 40%.

There is another headwind for the S&P 500 this week that he and others are watching — May options expiries, with those for the VIX

VIX

set for Wednesday and S&P 500 options for Friday. In each of the last six years, and 11 of the last 14, Krinsky noted that the S&P has been negative during this week, with an average loss of 1.3%.

Michael Kramer, founder of Mott Capital Management, also weighs in here, blaming some of the market churn on the run-up to those expirations.

“Generally, these option expirations have kept the market rangebound; currently, support for the S&P 500 is at 4,100 and resistance around the 4,150 level. This week’s focus will be on the bulls’ attempt to surpass the 4,150 mark for the S&P 500, while the bears are eager to bring it below 4,100,” he said.

Mott notes the stock market has consistently seen activity surges between 1:30 and 2 p.m. daily, and since jobs data earlier this month, a “notable” rise in demand has led to afternoon rallies for the S&P 500. He thinks this all looks mechanical, “indicating a buy-at-any-cost mentality,” and that options-related flows and hedging activity are probably an influence here.

Once those options expirations are through this week, many of the related effects for the market will probably vanish, he expects, though volatility may rise ahead of an appearance by Fed Chair Jerome Powell on Friday.

“Additionally, we know that the options market has placed the call wall at 4,200 for some time, and that is the options market’s way of saying it isn’t bullish on the market above 4,200 either,” added Kramer.

Read: The latest threat to stocks? A resurgent U.S. dollar.

The markets

Stock futures

ES00

NQ00

are rising, Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are steady and oil prices

CL

are slipping, while the dollar

DXY

is softer. Turkish stocks and the lira

USDTRY

are dropping as no candidate, including Turkish President Recep Tayyip Erdogan, got a majority vote in the presidential race, meaning a runoff in two weeks and lots of uncertainty in between.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

President Joe Biden said the second round of crucial debt-ceiling talks with congressional leaders will resume on Tuesday.

The Empire State manufacturing survey is due at 8:30 a.m. in a lighter week for data, with the exception of retail sales on Tuesday and housing starts on Wednesday.

It’s also a busy week for Fed speakers, kicking off Monday with Chicago Fed President Austan Goolsbee and Atlanta Fed President Raphael Bostic due to appear on CNBC ahead of the market open, followed by a speech from Minneapolis Fed President Neel Kashkari at 9:15 a.m. Powell, of course is at the end of the week.

Big retailers are in the spotlight, starting with Home Depot

HD

on Tuesday, Target

TGT

and TJX

TJX

on Wednesday and Walmart

WMT

and Alibaba

BABA

on Thursday.

Read: With major retail earnings on deck, this is what to look out for, say analysts

Pipeline operator ONEOK

OKE

is down nearly 6% in premarket after announcing a $18.8 billion cash-and-stock takeover deal for Magellan Midstream Partners

MMP,

which is up 8%. Australian gold miner Newcrest Mining

AU:NCM

said it would back U.S. rival Newmont’s

NEM

$17.8 billion takeover offer, a record deal for the industry. And Fanatics is buying the U.S. operations of Australia’s PointsBet

AU:PBH

for about $150 million. TPG

TPG

H&R Block

HRB

stock is down 8% and TurboTax parent Intuit

INTU

is off 4% ahead of an expected government report on a proposal to let individuals to prepare and file their taxes for free online directly with the IRS.

Shake Shack

SHAK

is reportedly facing a proxy fight from an activist investor who wants to boost the burger chain’s share price, which is up about 2.5% early Monday.

Embattled digital-media group Vice Media will be bought by a lender consortium including Soros Fund Management after it filed for bankruptcy.

Best of the web

‘The Fed is problem No. 1 in American finance,’ right now, says prominent market pundit

Inside the race to replace Larry Fink, the head of the world’s biggest asset manager, BlackRock

South Africa plans to investigate a gold mafia uncovered by Al Jazeera

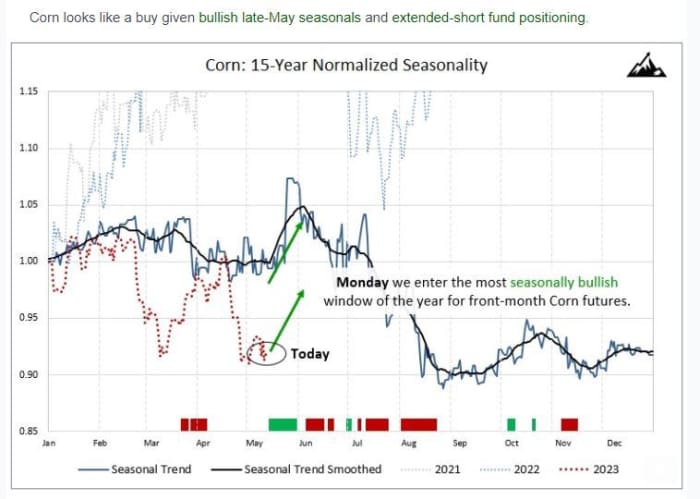

The chart

It could be an a-maizing (sorry) month for a major agricultural commodity. That’s according to Peak Trading Research, which says we are entering corn’s most “bullish multiweek window of the year.

Peak Trading Research

“Corn looks like a buy given bullish late-May seasonals and extended-short fund positioning,” says Dave Whitcomb, founder of Peak Trading Research.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

Random reads

Talking to babies is not jibberish.

Irish Times apologizes over hoax AI story about women using fake tans

“They’ve got to protect Percy Pig.” A very British ice-cream kerfuffle.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link

Leave a Reply